11 - 07 - 2023

By BPTW Partner, Neill Campbell, and Senior Housing Consultant at FFT, Robert Pratt, for The Housing Forum

In 2023, housing providers face some of the biggest challenges they have seen in recent decades. For example, new entrants competing for new build s106 affordable housing; reduced availability of grant and grant rates; debt costs; competing demands of building safety, sustainability and energy efficiency, and other stock investment requirements. These pressures impact on the capacity of Housing Associations and Local Authorities to fund new housing supply, and deliver on their core mission of providing more and better homes.

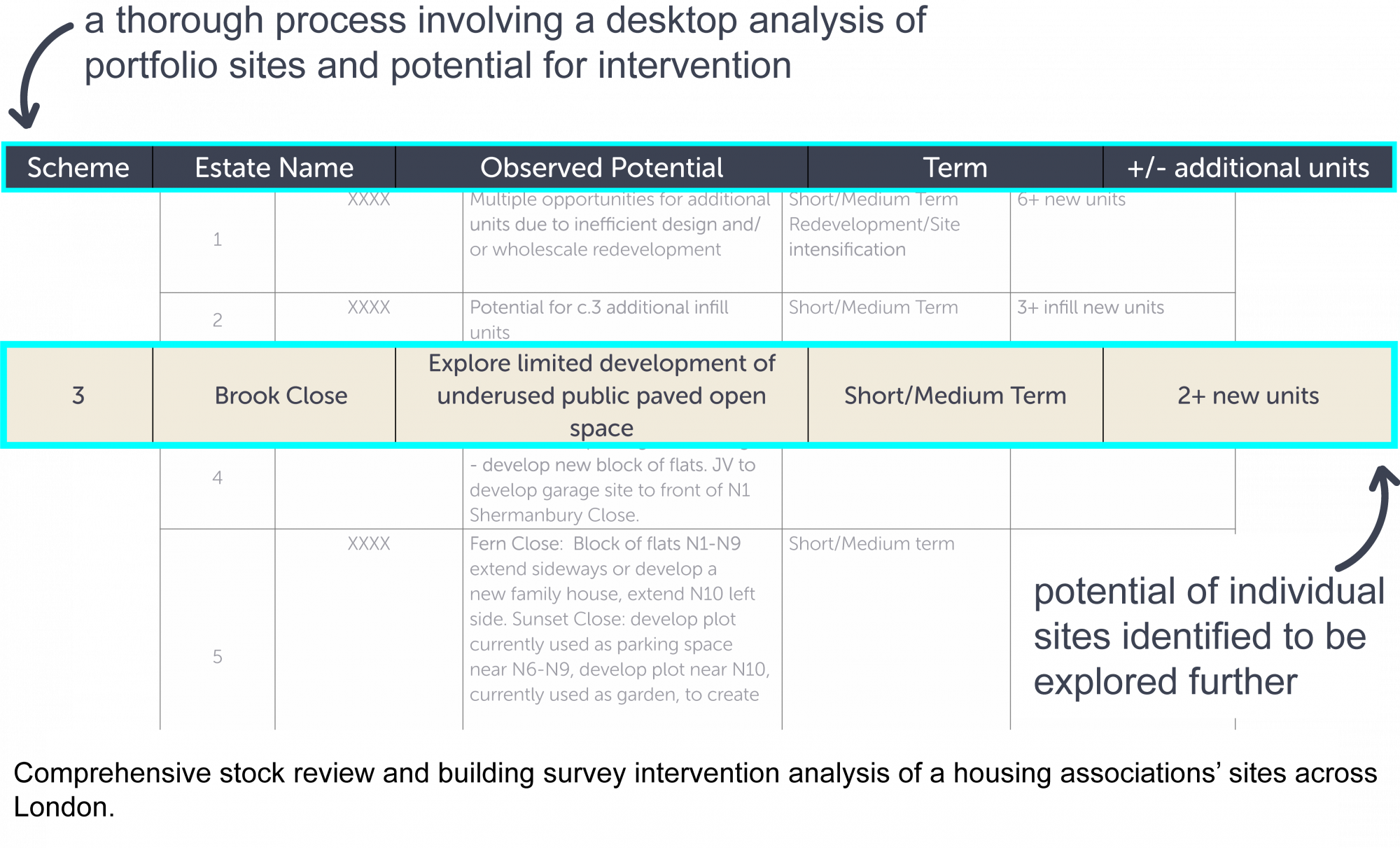

In response to these challenges, over several years BPTW and FFT have developed a well-considered, streamlined, and full-service approach to undertaking stock assessments for housing providers. Our approach uses a detailed understanding of existing housing assets and landholdings to help housing providers realise latent value and create opportunities to develop the potential of existing stock amidst the challenging context. Our approach also considers the vast opportunity to maximise the capacity of existing landholdings to deliver new homes.

For The Housing Forum’s recent ‘Housing Asset Strategy Forum’, BPTW Partner and affordable housing specialist Neill Campbell and Robert Pratt, Senior Housing Consultant at FFT, presented on our approach and the process and benefits of undertaking high-level regional portfolio reviews and housing stock assessments. These assessments give social housing providers a thorough picture of their assets and are critical in informing portfolio management objectives, like performance improvements and accommodating legislative change, to create better places and realise latent value.

You can watch the full presentation below.

A three-stage approach

BPTW and FFT’s holistic approach considers all or sections of stock in a client’s portfolio in three stages:

- Stage 1 – Strategic objectives and stock assessment to define client objectives and understand the current and target state of their assets. This stage of work involves:

- Clearly defining a framework of Strategic Objectives, reflecting the goals and priorities in the relevant geography.

- Understanding the Current State, enabling our clients to have a clear and thorough picture of the homes, assets, and land they own.

- Identify The Target State, setting out how this picture will change and over what time.

Stage 1 example: For Origin Housing Association, we used our level 1 assessment to review 1600 titles from a package of 7200 titles in London and beyond. The assessment’s primary thrust considered the opportunities for additionality in the existing stock.

- Stage 2 – Defining interventions for assets to inform decisions and support business cases. These may include investing in improvements to address building safety or energy efficiency; investing in regeneration, conversion, extension, or refurbishment; or disposing of non-core, high-value, or poorly performing assets.

Stage 2 example: BPTW and FFT worked with Hexagon Housing Association to conduct assessment levels 1 and 2 on housing stock in London and Kent, identifying architectural opportunities in parallel with building survey analyses. For example, the study identified an opportunity site with MMC and zero-carbon capabilities which was developed towards a planning application.

- Stage 3 – Architectural and urban design analysis deepens a client’s understanding of its stock and identifies potential for infill development, extension, or regeneration. This enhanced detail helps quantify the scale of additionality for housing supply and other benefits.

Stage 3 example: Appointed by Gravesham Borough Council, BPTW developed several sites that met a specific need for smaller, accessible homes in Gravesham. The study helped create innovative residential designs that encouraged ‘right-sizing’ to free up larger family homes, such as the award-recognised Constable Road. Many of the sites are now complete and occupied.

Architectural and Urban Design Analysis

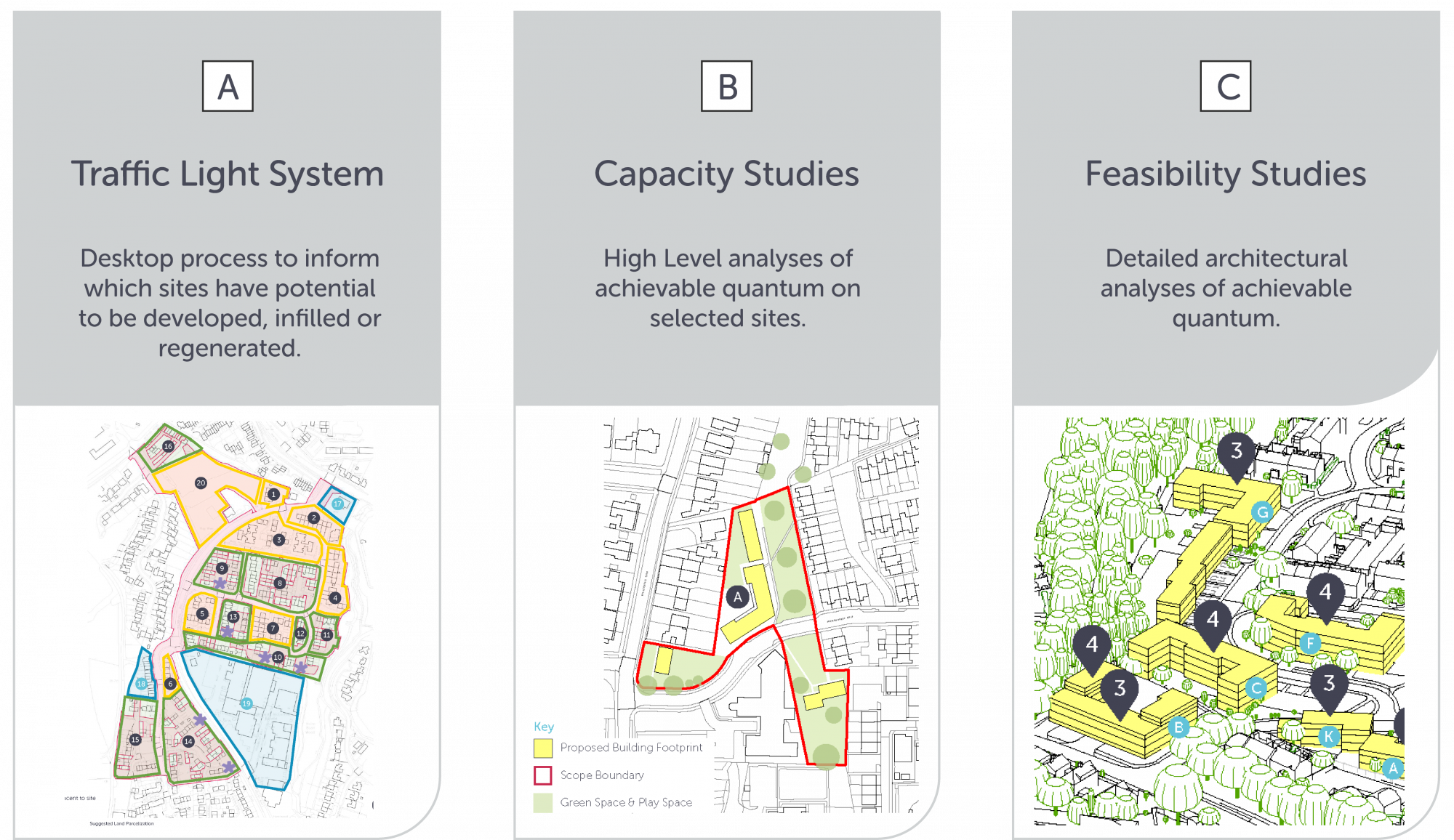

BPTW performs a three-level architectural assessment to identify specific interventions appropriate for a unique stock grouping. These studies support clients in making quick and informed decisions for or against development, prior to making a significant investment:

- A – Traffic light system – Using a desktop study, BPTW identifies the sites with development and regeneration potential and categorises them in a traffic light system based on the ease of development. The client’s criteria are defined early on to establish the emphasis for the categorisation process.

- B – Capacity Studies – BPTW conducts a high-level analysis of the achievable residential quantum for the selected sites informed by massing studies and indicative layouts. A policy overview and digital site analysis considering constraints, ownership, and observations help distil the suitable development opportunities per site, including retrofit, infill, and redevelopment.

- C – Feasibility Studies – BPTW’s detailed architectural feasibility study interrogates achievable quantum and viability for individual sites to inform development decisions. Information like massing studies, site layouts, and detailed accommodation schedules with tenure mixes establish the long-term viability of a given site. Building surveys can identify the issues impacting the existing housing stock.

Appointed by Opendoor Homes (LB Barnet), BPTW used our architectural and urban design analysis process to assess the development potential of over 20 small garage and infill sites in the borough. Guided by an emphasis on the speed of delivery, the traffic light system quickly categorised the sites with potential and those needing further consideration, with the ‘green’ sites (those with limited constraints) being progressed quickly. This process has supported the construction of 152 100% affordable homes on under-utilised land. At Prospect Ring in Barnet, BPTW’s analysis established a new red-line boundary and delivered five times the council’s anticipated residential quantum in a 13-storey tower, creating 50 new homes.

In a challenging context for housing development, BPTW and FFT’s high-level portfolio review and stock assessment process is helping housing providers understand the current condition and potential of their stock, aligned with their strategic objectives. To support the delivery of new homes, our capacity and feasibility studies on existing landholdings help quickly determine the achievable residential quantum to support client decision-making.

BPTW and FFT’s approach considers the vast opportunity to improve existing stock and maximise the latent capacity of existing landholdings to deliver much-needed new homes, helping Housing Associations and Local Authorities to tackle the housing crisis.

Neill Campbell is a Partner at BPTW and an affordable housing specialist. As a result of his extensive experience in council housebuilding, Neill regularly presents to professional bodies, such as the NLA, The Housing Forum and Future of London, on the development potential of residential sites across London and the South East. He also represents BPTW on Future of London’s Council-led Housing Forum.

FFT is an award-winning surveying and property consultancy, working principally with Registered Providers and public-sector clients. The Housing and Property Consultancy team provides best-in-class consultancy services, including stock rationalisation, strategic options appraisals and performance assessments.

BPTW is an active participant of The Housing Forum and its Partners and Directors have contributed to many talks and events to raise the quality of housing in England. You can read more about their contributions to The Housing Forum on our Insights page.